Executive Summary

There are several diamond trade centers in the world. The major ones discussed in this article are at Antwerp, Mumbai, Dubai, Hong Kong, and New York. All of these cities are different, each having its own history of diamonds and diamond trade.

Antwerp: The first major diamond city in the world. This city earned its right to be called the diamond capital of the world as most of the world’s diamond passes through this city. The oldest evidence of diamond sales was found in Antwerp and it dates back to the 15th century. Antwerp’s reputation in the diamond market has suffered a lot over time, especially the rough diamond market but it still has a stronghold over the polished diamond market.

Mumbai: The emphasis of the diamond industry in Mumbai is on exportation, as it accounts for up to 75%of the world’s total diamond export. It focuses mainly on importing rough diamonds and exporting cut and m polished diamonds.

Dubai: This is a relatively new diamond industry, but it is one that has made waves and is currently the second biggest diamond trade center in terms of the diamond trade. The creation of a favorable business environment, coupled with Dubai’s strategic geographic location are some of the reasons responsible for the rapid rise of Dubai’s diamond trade center.

Hong Kong: From inception, the development of Hong Kong’s diamond trade center has been to its close ties with China. The cheap labor available in China, however, means there’s no polishing company in Hong Kong. But Hong Kong is still very attractive to people who want to trade with China.

New York: The NY trade center is different from the rest as it does more to provide for the large market in the US than the manufacturing of diamonds. The importation of polished diamonds as of 2014 was estimated at $24.2 billion.

Article

The diamond trade center is a designated place for the manufacturing and trading of diamonds. There are several diamond trade centers in the world, some dating back to several centuries ago. But as the diamond market continues to grow, diamond trade centers have had increasing importance over the years. In this article, we look at the major diamond trade centers in the world.

Antwerp

Antwerp, the biggest port city in Belgium, is popular referred to as the diamond capital of the world, and it has been so-called for centuries now. Diamond trading started in Antwerp when rough stones were first brought in from India (which was the source of all diamonds in the world till the 18th century).

Bruges was first known as the hub of diamond activity in Europe until attention shifted to Antwerp. It was in Antwerp that traders benefitted from better facilities for communications and exchange at the time. By the close of the fifteenth century, Antwerp was already the world’s primary diamond center, with its strategic location (on Scheldt river with direct access to the North Sea) playing a huge role. By the sixteenth century, Antwerp had already developed into a flourishing and fascinating city. Then it started playing significant roles in the different techniques used for developing diamonds. The city’s fame continued to grow from then and it became the world’s center for diamonds. Local diamond traders in Antwerp also rose to prominence, so much that King Francois I of France started to order for diamonds from cutters in Antwerp instead of those in Paris.

The oldest evidence recorded of the existence and history of diamond trade deals in Antwerp dates all the way back to 1447. A city magistrate had issued an edict to ensure strict measures are taken against trading of false precious stones (including diamonds) at the time. The invention of the scaif in 1456 by Lodewyk van Berceken further enhanced Antwerp’s fame. The scaif, a polishing wheel mixed with diamond dust and olive oil, was used to polish the diamond facets symmetrically and at angles that reflect light best. This created the stereotypical shining diamonds that we know today. Later, in the year 1477, Archduke Maximilian of Austria engaged his yet-to-be wife, Mary of Burgundy, with a diamond ring. This was the start of diamond engagement rings as we know it today and diamond trade in Antwerp has been flourishing since then. When Vasco da Gama discovered a sea route directly to India from Antwerp in 1498, he further cemented Antwerp’s position as the world’s diamond trade city.

After World War II, the diamond industry was dominated by the Jewish community. This helped to, once again, resound Antwerp’s dominance as the world’s diamond trade center as it created a new market for customers to get these sought-after stones.

The AntwerpWorld Diamond Centre (AWDC) was established in 1973. It is a globally recognized and renowned company that officially coordinates and represents the diamond sector in Antwerp. It is located in Hoveniersstraat, from where it oversees the importation and exportation of diamonds in and out of Antwerp.

Antwerp Diamond District

It is also called Diamond Quarter (Diamantkwartier). It is an area in Antwerp that covers an area of only about 1 sq. mile. It is located adjacent to the Antwerp Centraal (the central station). The distance to the main shopping street in Antwerp, Meir, is a few minutes’ walks. This area is known historically for cutting and polishing diamonds. Although, as in 2012, most of these works have moved to other centers with lower wages, 40% of all industrial diamonds, 50% of polished diamonds and 85% of rough diamonds in the world today still pass through the diamond district in Antwerp at least once. This further highlights the importance of this city to the world diamond industry.

There are 4 most important diamond markets which are located in the diamond district of Antwerp. Each of these markets has its own diamond expertise:

- The BeaursvoorDiamanthandel: This market specializes only in polished diamonds.

- The VrijeDiamanthandel: This market specializes in both rough and polished diamonds.

- The Diamond Club van Antwerpen: This market also specializes in both rough and polished diamonds.

- The AntwerpseDiamantkring: This market specializes only in rough diamonds.

Till date, Antwerp retains its status as the world’s diamond capital with over 1500 diamond firms having their headquarters in the city. This is the largest concentration of diamond firms in the diamond industry. As diamond mines from Canada, Russia, Australia, and South Africa continue to send more diamonds into Antwerp.

Diamond Market in Antwerp

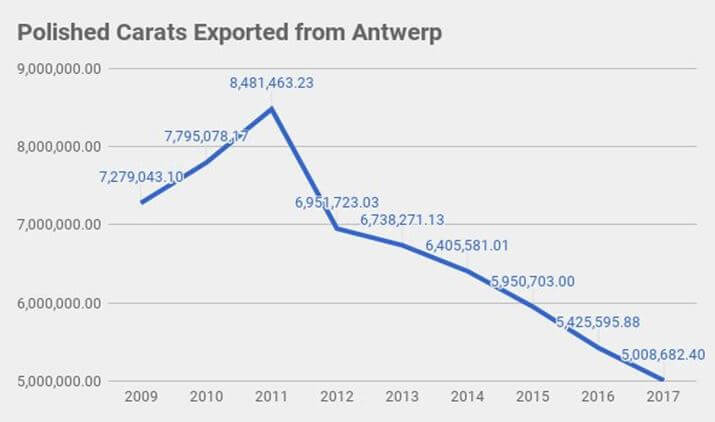

It can’t be denied that Antwerp’s reputation as the world’s diamond trade capital has taken several hits down the centuries. Presently, it maintains its reputation majorly on rough diamonds because of its legacy, expertise of its workforce, infrastructure and its central geographic location for the global diamond industry. But Antwerp’s grip on polished diamonds has loosened since the rise of Mumbai. There has been a recent rapid decline in the wholesale trade of polished diamonds in Antwerp. The chart for the exportation of polished diamonds from Antwerp is shown below.

Many polished stones do not pass through Antwerp as they used to before. This is mainly due to the high cost involved in comparison to other markets.

The diamond retail market in Antwerp has also taken a huge hit and there’s a fall in the market’s value. This is because diamonds sold on the retail market in Antwerp has the exact same source (India) as those on retail in other parts of the world. The ability to now purchase diamonds from online retail stores has done much to crush the Antwerp diamond retail market.

Antwerp is one of the world’s most expensive cities. This means that there are more overhead expenses and the retailers need more money. But there really is nothing special about the diamonds on the retail market in Antwerp anymore. It’s the same with those anywhere in the world, so why should I buy a more expensive diamond in Antwerp when I can get the same diamond much cheaper online?

Diamond retailers in the diamond district are finding it hard to compete with online retailers and the reason is obvious. Online retailers have smaller margins to cover and can afford to sell their diamonds for much cheaper than the retailers at Antwerp can. This has caused these Antwerpretailers to result to trickery when selling to their customers. If you’re buying diamonds from the retail market in Antwerp, you have to be extra careful, or at least have a little education on diamonds.

These are some of the tricks which the retailers use:

- Treated diamond: This is the most common trick. It’s impossible to even compare these diamonds with natural diamonds because they have been treated and it’s impossible to resell them. Yet these diamonds are very much in sales and retailers don’t even mention that the diamonds are treated, or they just downplay the downsides to buying a treated diamond.

- Sales of non-certified diamonds: This is also very common in the retail market. Many of the diamonds put up for sales aren’t certified by GIA or other trusted grading lab. Yet they are extremely expensive by all measures. In reality, you could get a better, certified diamond elsewhere at a cheaper price than what you’ll be offered in Antwerp.

- Excessive prices: Although we have mentioned before that Antwerp is an expensive city. But nonetheless, the prices of diamonds here are just plain extortion. This is coupled with the fact that the diamonds aren’t even what the sellers claim that they are. Most of the diamonds are treated, uncertified, and yet extremely expensive. Yet the sellers try to push the narrative that you can’t get a better deal elsewhere…Lies!

Mumbai

The diamond industry in India is the biggest in the world accounting for about 75% of the world’s total diamond exports. It is the largest diamond cutting hub in the world based on the number of people that it employs (850,000) and its total value. India has a reputation for importing rough diamonds and exporting cut and polished ones. In 2018, the importation of rough diamond rose by 24.5% totaling 149.8 million carats when compare with the previous year. The exportation of cut and polished stones also rose by 28.3% totaling 59.9 million carats.

In 2015, the Indian government set up a Special Notified Zone (SNZ) in Mumbai majorly for the sales of rough diamonds. This SNZ is now referred to as the Indian diamond trading center (IDTC) in Mumbai. In this trade center, the sales of a rough diamond aren’t taxed by the government. The reason for opening this diamond trading center was so that India will be able to compete with other diamond trading hubs like Antwerp, Israel, and Dubai. India is renowned worldwide for cutting and polishing diamonds but 90% of the diamonds processed in India are actually imported. The IDTC in Mumbai was created to reduce this importation. The trade center provides rough diamonds for manufacturers in India to cut and polish without having to travel round the globe.

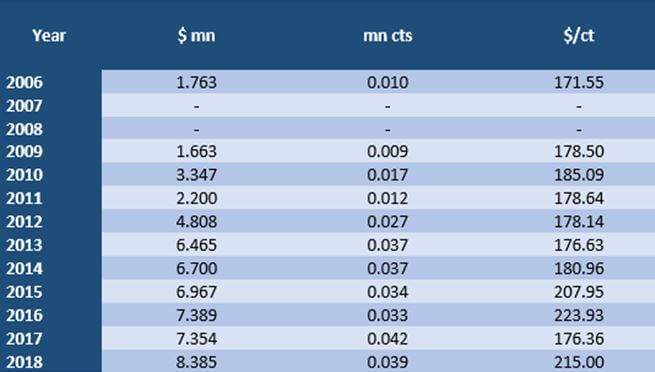

Although India has its own primary alluvial deposit that is located in Madhya Pradesh, with a lot of other alluvial diamond deposits, diamond production in India is very small, only about 40,000 carats yearly. Even though the reserves are estimated at 2.6 million carats. The country has placed its emphasis on diamond importation rather than diamond production and is rightly viewed as the world’s largest consumers of the rough diamond. The charts below show the production of diamonds in India in comparison to the importation of the rough diamond and the exportation of polished diamonds.

The creation of the diamond trading center in Mumbai was intended to make diamonds cheaper in India. This is because it eliminates middlemen. Traders are able to deal directly with international miners and manufacturers without going through middlemen. According to industry data, 85% of the world’s diamonds are cut and polished in India but only about 15% are imported directly. The remaining 60% are brought in through middlemen. The IDTC allows miners to directly invite bids from polishers for their rough diamond. Indian diamond traders are also able to buy directly from the miners. This eliminates middlemen and saves some cost on the transaction.

The Bharat Diamond Bourse (BDB) played a key role in setting up the diamond trade center in Mumbai. It is the largest diamond bourse in the world and is responsible for handling 60% of diamond exportation from India. India is definitely a force in the global polished diamond market, having an 80% share by volume, 92% shares by the quantity of diamonds and 60% shares by market value.

Dubai

Dubai doesn’t have a diamond history that dates back as far as India’s or Antwerp’s does. Although it has a relatively short diamond history, it has grown to become one of the world’s most important diamond trade centers. It offers a convenient location and a modern bourse that makes it an important trading center for rough diamonds.

The UAE (of which Dubai is one of the emirates) only became a part of the Kimberly Process Certification Scheme in 2003, and the Dubai Diamond Exchange (DDE) was established in Dubai in 2004. Dubai has a rich history for being a regional trade center, so the offer of a tax amnesty for 50 years to diamond manufacturing companies by the DDE, made Dubai a very attractive option for many diamond firms. Many companies that had their headquarters in Belgium and India opened new offices in Dubai’s DDE and started to trade there as well.

One key factor for the rapid growth of diamond trade in Dubai is the building of the Almas Tower. The Almas tower follows the same mode as Israel’s Israel Diamond Exchange and India’s Bharat Diamond Bourse. This tower provides a close and secure environment for diamond traders with everything that they need available to them. It has a diamond auction facility, DDE trading floor, and other diamond related services.

Another advantage responsible for Dubai’s rapid growth as one of the world’s diamond trading centers is its geographical location. The Arab Gulf region is a major consumer in the diamond market. It was therefore easy to access a large customer base and vice versa. Dubai now serves diamond consumers in the whole of UAE and they purchase diamonds worth billions of dollars yearly. It is also a middle point between Africa and India. Africa happens to be the world’s largest producer of rough diamonds and India is the world’s diamond polishers. This prospect attracted many companies who were quick to establish themselves in the DDE.

To illustrate Dubai’s rapid growth, we can go back to a 10-year period between 2001 and 2011. In 2001, before the formation of the free trade zone in 2002, the total diamond trade-in Dubai was just $5 million. This kind of sale in the diamond industry is really no sale. But by 2010, the volume of diamonds (both rough and polished) traded in the DDE was 286.7 million carats, worth a total of $35.1 billion. The value of diamonds that was traded in that year doubled and the volume of trade rose by 50% in comparison with the previous year.

By November 2011, there was a new diamond trade record. The DDE reported that 206.1 million carats worth $25.3 billion were sold only in the first half of the year. This was a 35% increase from 2010 when it sold 131 million carats of diamond worth $16.3 billion in the first half of the year.

Dubai’s rise seems to come at Antwerp’s expense. At the time, taxation was high in Belgium and there were several raids by police and tax authorities on diamond firms. This created an unpleasant business environment and many firms moved their base to Dubai which has a more favorable economic climate. This shift seems to have stopped in more recent years with the size of Dubai’s diamond industry remaining at an approximated $35 billion in 2014.

Comparing the volume of trade in 2018, which was $25 billion to $3.5 billion in 2004, there has been a growth of 614% in the years in-between. But when you compare those figures to the 2011 figures, it is evident that the shift has stopped. However, Dubai is still currently the second in the world in terms of the diamond trade.

There are 2 places in Dubai where traders trade their diamonds, the Dubai Multi Commodities Center and the DubaiGold and Diamond Park.

The DubaiMulti Commodities Center (DMCC) is a hub for trade and commerce for any kind of venture. But the major trades are diamond, gold, and other precious metals. There are a lot of benefits for investors in the DMCC;

- 100% ownership of the company.

- No personal or corporate taxer.

- 24/7 secure business clime.

- Total repatriation of capital and profits.

- World-class facilities and infrastructure.

- No limitations in trading in the free zone and outside the UAE.

The DubaiGold and Diamond Park focus more on jewelry business. The aim is to provide a collection of all the precious jewelries in the world here. It has, therefore, become an attractive spot for foreign tourists and local residents too. Investors here enjoy all the benefits of the Dubai free zone in addition to;

- Assistance for all issues related to the government.

- Freedom to hire foreign expatriates

- Convenient transport system

- Hallmarking facilitated by Dubai Municipality.

Hong Kong

Diamond trading history in Hong Kong dates back to the 1950s. Local diamond traders in Hong Kong formed an association in 1959, the Diamond Importers Association (DIA). It was a non-profit organization that raised Hong Kong’s profile as a diamond center in the Asian region. Although Hong Kong had a history of being a trade center, it was in the 1970s that it developed into an economic and banking center and it became a major trade powerhouse.

Hong Kong’s diamond trade took a step forward when China started opening up to the global economy in the early 1980s. The development of factories, near Hong Kong’s border, in special industrial zones was monumental for Hong Kong. By 1985, there was enough manufacturing and trading of diamonds to establish the Hong Kong Diamond Bourse (HKDB). The HKDB became a member of the World Federation of Diamond Bourses (WFDB) in June 1987. At the time, there was already an important diamond market in the Asia-Pacific region, big enough to create an international hub in Hong Kong.

More manufacturing industries were established in Hong Kong, as they became closer to China, as the United Kingdom transferred sovereignty to China in 1997. It was, however, uneconomical to polish diamonds in Hong Kong due to the lower cost of labor in China. Till date, Hong Kong still doesn’t have a polishing plant in it.

Hong Kong’s low tax and free trade make it attractive for companies that want to trade with China. Diamond trade in Hong Kong has majorly been exported. According to a quarterly report of employment and vacancies statistics in December 2014, there were about 400 jewelry making companies in Hong Kong, employing 13,000 people, with over 2000 active exporters. In 2014, 27% of diamonds and jewelries were exported to the US. This rose to 30% in the first 6 months of 2015. Over 16% were exported to the EU in 2014, 12% to Switzerland and 11% to the UAE in 2014.

The diamond federation of Hong Kong DFKH was formed in 2000 by the two previously formed local diamond organization, DIA and HKDB. The DFKH has since aimed at building and sustaining Hong Kong as the “World Diamond Centre”.

Slowly but steadily Hong Kong has risen into an important hub for wholesale and retail sales in the diamond industry. There are many benefits to sourcing and trading diamonds in Hong Kong. Some of them are:

- Good protection and legal system: This is with support from the government and other authoritative organizations.

- Confidence: Members of the DFHK are trustworthy to partner with.

- Ethical business practice

- Value for money: The import and export procedures are very simple and the ports are tax-free. No value-added tax, or sales tax.

- Quality: High-quality control regulations mean that you can trust the quality and workmanship of the diamond you’re provided with.

- Product range: Being the diamond trading center of Asia, there is a wide variety of diamond types to meet various demands.

- Service: A common business practice in Hong Kong is the “after-sales value-added service”. This ensures a long business relationship.

New York

The diamond centers in New York is a different type of diamond center to the others. The other diamond centers are majorly center for manufacturing and trading but the New York diamond center does a lot less manufacturing. The US is a large consumer market and the trading center in New York acts as a gateway to reach the American market.

The earliest document to show for a diamond center in New York is documentation from the 18th century, at the maiden lane. In the 1920s, a larger center was developed near bowery and canal street.

A number of diamond traders came together in 1939 to form an exchange that was modeled after the European diamond exchanges. The diamond dealers club (DDC) was formed, and the offices were in lower Manhattan on Nassau Street.

The New York diamond center was originally formed from the turmoil that came with WWII. Many of the Jews that were persecuted in Europe by the Nazis fled into the US and Tel Aviv for refuge. They later established diamond centers in these cities they ran into. They started again from scratch with their expertise and knowledge of polishing diamonds. They later developed into a diamond community. After the war, when economies started flourishing again, the demand for diamonds increased again and they soon found their foot back.

New York is home to many of the most famous diamond cutters in the world including Lazar Kaplan, Marcel Tolkowsky and Brian Gavin.

As at 2014, the consumer market in the US is estimated at $28 billion in retail sales and the gross polished diamond imports were estimated at $24.2 billion.

The diamond district in New York is also an important sales hub. It not only serves the retailers but also numerous visitors and tourists who seek diamonds from the traders in that region. There’s an estimate of about 2,600 independent diamond businesses in the NYC diamond district. The famed Gemological Institute of America (GIA) is also located in the area.

Conclusion

The major diamond trading center highlighted in this article are different in many ways. They all have their different peculiarities and histories. Trading in these trading centers might also be slightly different from each other but you’re sure going to find them all favorable for trading. But with the facilities available in Dubai and the DMCC already working to make Dubai the largest diamond trading center in the world by 2023, I would not bet against the diamond trade power shifting to Dubai.